January 9th, 2023 at 07:00 am

How to Compare and Buy Travel Insurance Online

Travel can be unpredictable at any time. If your plans change, you stand to lose more depending on how many people are traveling and how many hotel rooms and flights you’ve booked.

Some journeys, like overseas travel or a month-long vacation, are riskier and require travel insurance.

If you prepay for your vacation and your cruise, plane ticket, or hotel has tight cancellation policies, travel insurance is an excellent choice. If you don’t have medical insurance in your destination, it’s wise.

Why Assess Travel Insurance?

After selecting travel insurance, compare. Your travel agency’s first bundle may not be ideal.

Booking websites and travel providers typically offer partial plans that don’t include travel insurance or trip cancellation. In an emergency, “waivers” or credits against future bookings are useless.

High-priced insurance may not cover everything. Comparing options boosts buying power.

You won’t need to enter the same travel information for each plan because you may view numerous plans in a single, easy-to-read chart.

Step 1: Travel Information

For an accurate quote, you’ll need some trip details. It includes:

- How much your trip will cost

- The dates of your trip

- Where you’re going

- How many people are going

- How old everyone is.

- Your permanent residence

- When you made your first deposit or payment.

You don’t have to enter any personal information yet. You’ll only have to give your name and contact information when you decide on a plan and buy it.

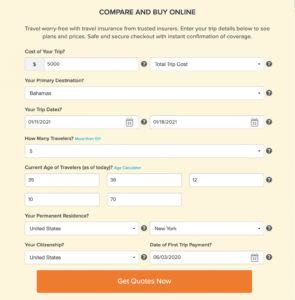

When you fill out the form it looks like this:

Travel Insurance Quote Form: This is an example of a family of five from New York who filled out the travel insurance quote form for a one-week trip to the Bahamas.

If you don’t know how to answer a question, you can move your mouse over the question mark to find out how. We’ve filled it out with sample information for a one-week trip to the Bahamas for a family of five with two kids and a grandmother.

Step 2: Make your search more specific

Now choose your policy coverage. You’ll have less insurance coverage to pick from if you know what you need and don’t need. Examples:

Flight Cancellation Insurance: If your trip is delayed or canceled due to sickness, natural disaster, or another unforeseen event, trip cancellation insurance covers nonrefundable charges like flight and hotel reservations.

It doesn’t cover work-related or family-related trip cancellations. “Cancel for any reason” coverage is more expensive and must be obtained soon after booking your trip.

Trip Interruption Insurance: Like cancellation insurance, vacation interruption insurance covers concerns after your trip begins. If someone at home gets sick, you may have to cut your trip short. If your return flight is delayed, you may have to pay for extra nights. Trip interruption insurance can cover these charges.

Baggage Loss and Delay Coverage: Covers lost, damaged, or stolen luggage. Reimbursement per bag is normal.

Emergency Medical Insurance: Your health insurance plan may not provide enough emergency medical coverage for your destination. Some health care plans cover “acceptable” medical costs abroad, while supplemental medical insurance covers more situations.

Travel insurance can cover ambulance, hospital, and emergency medical evacuations back home. When comparing health care policies, you must consider coverage restrictions and deductibles.

Other add-ons include rental car collision coverage and preexisting condition exclusion waivers.

Some Travel insurance companies let you choose your coverage after entering your trip details.

You can use a “Narrow Your Search” tool such as this to find the coverage you need for your trip and get rid of the options that don’t have what you want.

3: Compare Travel Insurance Plans

Compare your options now. The results page displays the plans that suit your criteria, along with their prices, companies, coverage options, and star ratings.

Price and category coverage can be sorted from low to high. Our example policies cover 100% of travel cancellation and 150% of trip disruption. Medical evacuation costs $250,000–$1 million, whereas baggage loss costs $500–$1,500.

Click on a plan to view more details and obtain a PDF with the full coverage. Click on reviews to discover what other travelers think of the policy. Some providers offer a “Cruise Plan” with larger coverage limits for cruise bookings, which costs extra.

Click “Add to Compare” to compare an insurance you like later. You may update your travel details and search filters on the right.

Sample Bahamas travel insurance quotes. Most quote results offer 25–35 top-rated insurer plans.

When you click “Compare Now,” a chart shows your selections. You’ll notice the underwriter’s name, A.M. Best Rating, and coverage specifics, including cancellation and medical coverage.

This travel insurance comparison table shows policies side-by-side.

Worldwide Travel Assistance may involve legal referrals, translation, and ID theft resolution.

Click on a perk for more details. This box lists benefit coverage, definitions, and exclusions.

Most trip cancellation policies cover Insured, Family Member, or Traveling Companion Sickness, Injury, or Death. Click “View Information” to view policy details. You’ll see this benefit’s full coverage details. Definitions and exclusions are on other tabs.

Clicking on any benefit opens a light-box with coverage information, definitions, and exclusions.

To cancel a plan, click “Remove Policy” at the top of the page, or click “Buy Now” to buy it online.

Step 4: Get insurance for your trip

After choosing a policy, most insurance companies let you buy it straight from the provider at the lowest guaranteed price. You must submit your address, credit card information, and the names and dates of birth of all travelers.

Travel insurance may be purchased on one page with our guaranteed lowest pricing. Email confirmation of coverage follows purchase.

To ensure you have enough coverage, check your Rental Car Damage and Cancel for Work Reasons options.

If you’re undecided, get a quote via email. Click “Back to Quote Results” then “Email Quote” for any plan. Email policy details to yourself.

A comparative tool simplifies travel insurance shopping.

You’ll also receive a fast email confirmation of coverage, so you don’t have to worry before your travel. If you have to file a claim, you’ll know how much and what’s covered.

Compare and buy top-rated travel insurance policies HERE.

Related Stories

- TRAVEL INSURANCE FOR RELATIVES VISITING THE UNITED STATES

- USA TRAVEL HEALTH INSURANCE THAT COVERS PREGNANCY

- WHAT TO KNOW ABOUT MEDICAL EVACUATION INSURANCE PLANS

- WHAT TO KNOW ABOUT PREGNANCY AND TRAVEL INSURANCE COVERAGE

- A GUIDE TO THE BENEFITS OF TRAVEL INSURANCE BEFORE AND AFTER DEPARTURE