June 15th, 2022 at 02:47 pm

5 BEST PERFORMING CENTRAL BANK GOVERNORS IN AFRICA

The Central Banker Report Card which has been published yearly since 1994 by Global Finance has ranked the central banks of some countries including the European Union, the Eastern Caribbean Central Bank, the Bank of Central African States, and the Central Bank of West African States.

According to the report, only two central banks from Africa made it to the top 10. Governor of Bank al-Maghrib (Morocco), Abdellatif Jouahri for the fourth time in a row earned the highest distinction of grade A. He was praised for his effort of tripling the Amount of money in the commercial bank and expanding the types of bonds the Central banks will accept in exchange for refinancing.

Also, Tarek Amer the Governor of the Central Bank of Egypt (CBE) scored an “A” grade for his efforts to restore Egypt’s macroeconomic stability. The rankings made by the Global Finance assessed the Central banks based on inflation control, economic growth goals, currency stability, and interest rate management on a scale of “A” to “F.” (“A” denotes exceptional performance, whereas “F” denotes complete failure.)

Below are some African Central banks and how they fared in the Central Banker Report Card.

1 . Firstly, EGYPT – TAREK AMER: GRADE A

He managed an IMF back reform program for three years and that led to the restoration of Egypt’s macroeconomic stability. The Central bank, during the coronavirus pandemic in March 2020, responded to the impact by decreasing its overnight deposit by 300 basis points to 9.25%. Also, it deferred the payment of credits owed by individuals and institutions without imposing any fines on those that delayed payment.

2 . Secondly, MOROCCO – Abdellatif Jouahri: GRADE A

Morocco’s central bank, Bank al-Maghrib, reduced its policy rate by 25 basis points in March to 2% in response to the effects of a drought and the coronavirus. The Central bank tripled the amount of money in the commercial bank and expanded the types of bonds the Central banks will accept in exchange for refinancing.

Also, the Professional Group of Moroccan Banks agreed to allow corporations and individuals who owed to defer payment by paying it in installments.

3 . Thirdly, KENYA – Patrick Njoroge: GRADE (B+)

During the beginning of the pandemic, the central bank reduced its benchmark rate by 125 basis points to 7%. It also decreased the requirements of reserve and allowed commercial banks to restructure distressed loans.

4 . Also, RWANDA – John Rwangombwa: GRADE (B+)

The Central bank of Rwanda was able to quickly address the effect of the coronavirus pandemic on their economy. The Central bank in April cut its benchmark interest rate by 50 basis points to a record low of 4.5%.

It also allowed commercial banks to modify the outstanding loans of debtors. To assist local banks in supporting businesses, the government announced a $52million package to the banks.

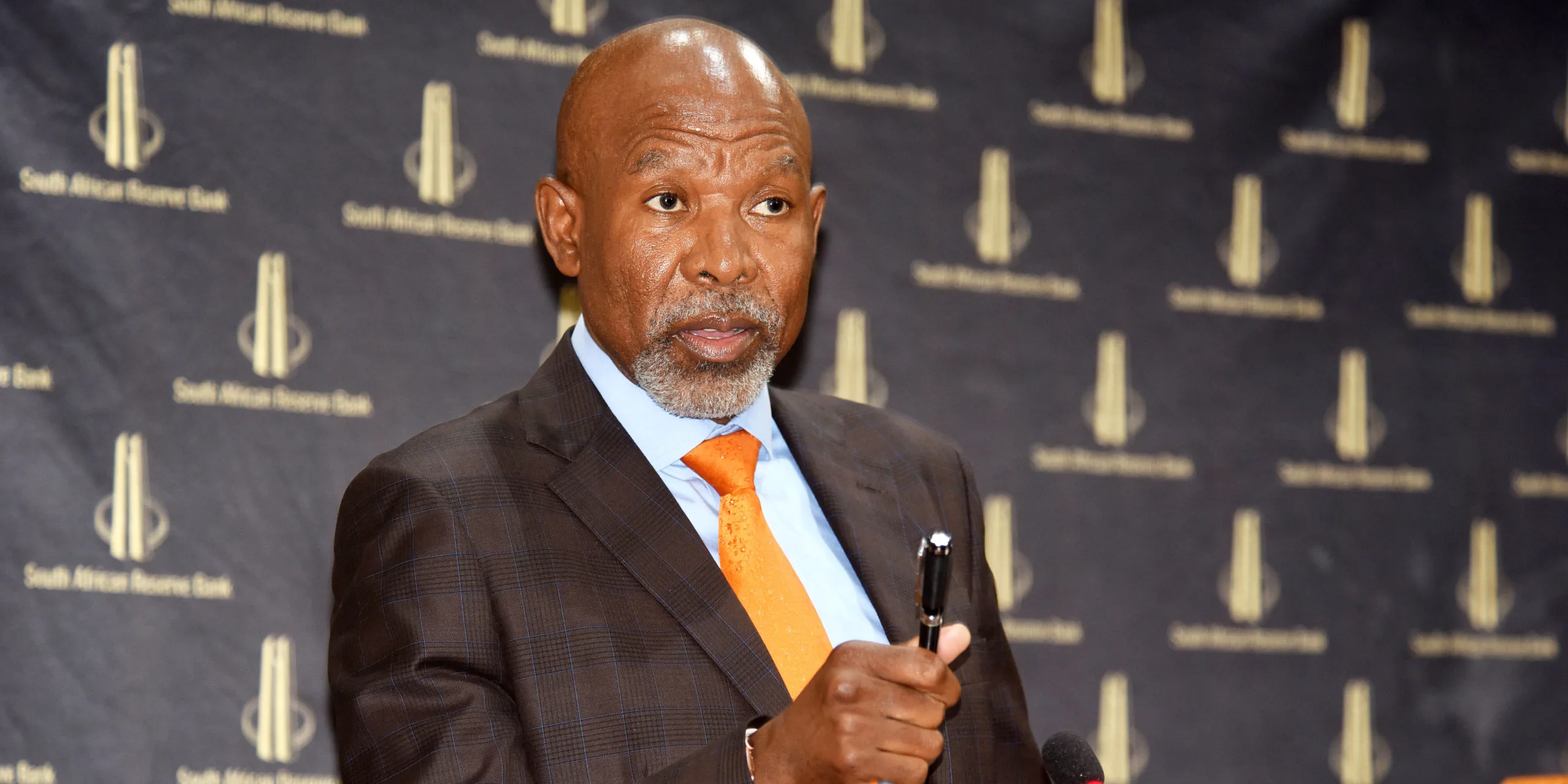

5 . Last but not least, SOUTH AFRICA – Lesetja Kganyago: GRADE: (B+)

The Central bank reduced the interest rate 5 times lower to a record of 3.5 percent through July as the economy worsened and inflation remained low at a percentage of 2.1% the lowest the country ever had in 15 years.

Also, for More Interesting Articles, CLICK HERE

RELATED SEARCHES

- Top 5 African Countries with the Best Education Systems

- HOW TO GET A UK VISA IN GHANA

- What You Need To Know When Starting A Business

- What You Need To Know When Buying A Car

- How Do I Get Rid Of The White Stuff On My Tongue

- Get Rid Of Vagina Odour Immediately

- HOW TO PREPARE PIZZA FROM THE COMFORT OF YOUR HOME

- HOW DO I KNOW MY BLOOD GROUP

- KNOW WHY YOU SHOULD NOT MARRY PEOPLE WITH CERTAIN BLOOD GROUPS

- How Can I Stop White Discharge and Itching Naturally

- How to stop menstrual pains fast at home

- What Are the Symptoms & Signs of Gonorrhea and Syphilis?

- How can I stop the pain when I urinate?

- How can I stop sperm from coming early?

- Apply for Police Clearance Certificate in Ghana